Services

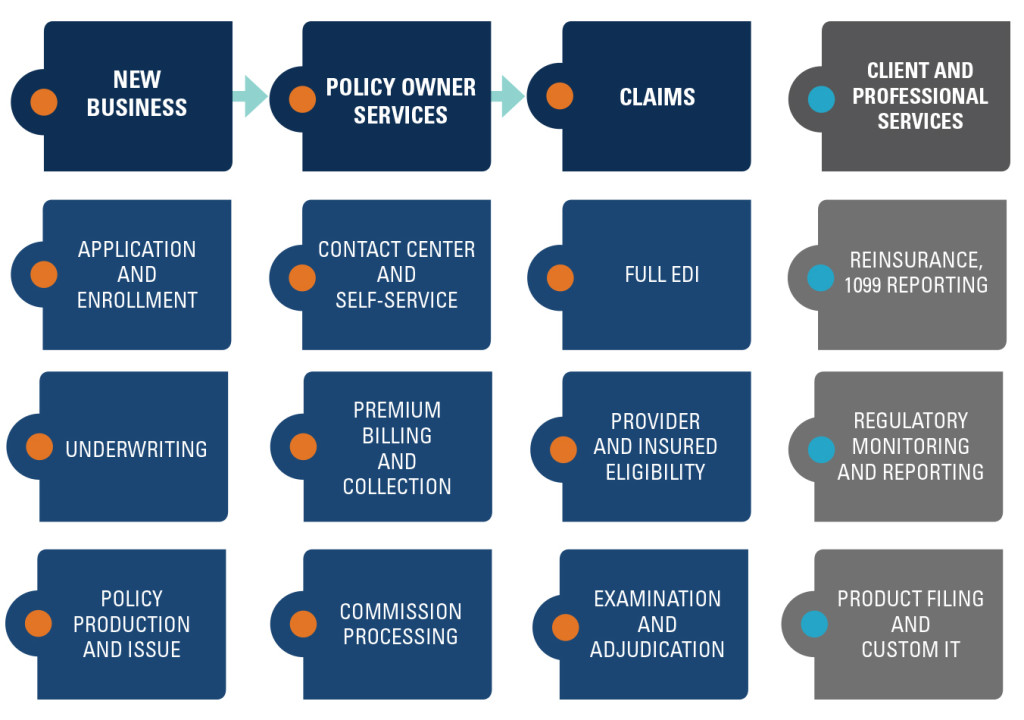

Reduce paperwork and minimize the administrative burden on your in-house staff by letting us manage new business processing. Our proven methodologies and industry expertise can help you shorten the new business cycle while increasing volume and reducing overhead costs. We capture application data from the point of receipt and automate document classification to expedite processing and ensure accuracy. We can even send a message to the insurance agent or insurance advisor when information is missing. Learn more about our New Business Services.

IAS experts will advise on the design and regulatory requirements for traditional paper insurance applications. We can even file applications along with policy forms and other materials for clients needing full turnkey services.

Whether you are looking for simple application processing or in-depth client interviews, IAS can handle all of your insurance underwriting needs. We will work with you to design an underwriting process that conforms to your company’s guidelines, and we stand on our commitment to exceptional customer service. Learn more about our Underwriting Services.

Once an application is approved, IAS assembles, packages and delivers a professional looking policy, in paper or electronic format, per your exacting standards. And with our policyholder portal a full copy of that package is always available to the owner, with just a few clicks.

From policy issue to premium billing, we offer comprehensive policy maintenance services, and our knowledgeable and friendly call center representatives will ensure your policyowners receive exceptional support. Learn more about our Policyowner Services for Life Insurance Products.

Every IAS client is given the unique toll-free number for policyholders and agents. As an extension of your brand we seek to understand and embrace the culture of your organization, the level and quality of service your customers have come to know and expect when doing business with you. We then emulate that experience, and have a proven record of service excellence across industry metrics such as average speed of answer and abandon rate.

More and more today policyholders and agents want service automation, to fit their busy schedules, from their desktop to their mobile device. IAS manages a unique suite of portals, for policyholders, for agents, and even a portal for Medicare providers seeking benefit and eligibility information about their patients. These portals are easily customized to fit your brand requirements, and are constantly evolving to keep pace with advances in technology and the ever increasing demands of our customers, and yours.

We bill and collect premiums across all modes and funding mechanisms for the individual, group and list-bill insurance markets. As part of our comprehensive Insurance and Reinsurance Accounting services, we offer all types of premium billing, including electronic funds transfer, direct billing, group list bills, and government allotments. For premium collection, we use bank lock boxes and remote deposit capture to ensure you receive same-day credit for all premium deposits. Learn more about our Insurance & Reinsurance Accounting Services.

We offer a comprehensive compensation system and commission management support for Insurers, IMO’s, BGA’s, brokers, agents and insurance agencies, including commission advances and earned commissions. Our dedicated agent portal makes it easy for producers to manage their business and track their earnings, reducing back office administrative tasks for your business and increasing agent retention. Learn more about our Commission Accounting & Processing Services.

More than 90% of our Medicare Supplement, life and health insurance product claims are received and processed electronically, reducing paper waste and ensuring a quick and accurate turnaround for your customers. We also pay insurance claims on products requiring rigorous eligibility review at the point of claim, such as Long Term Care and Disability insurance. We process more than 3.5 million claims annually and pride ourselves on prompt, efficient and courteous customer service. Learn more about our Medicare Supplement Claims Processing Services.

Fully automated Electronic Data Interchange (EDI) for high-volume transactional claims associated with ICD10 dependent health products.

Many of the product types for which we pay claims, such as LTC and Cancer, require the expert analysis of a seasoned insurance claims professional to accurately determine eligibility. In some cases, eligibility must be assessed for both the provider and the insured. IAS has the staff, tools and expertise to manage these complex claims.

When claims arrive, IAS carefully inspects the requested benefits and pays all approved claims with accuracy and expediency, offering insurers and providers a range of payment options.

Insurance administration at IAS is a set of complex tasks made simple. We are insurance industry experts, first and foremost, and we understand that no two companies are alike. So we take a consultative approach and wrap around our administrative solutions with a full suite of professional services. From policy drafting, to compliance filing, to regulatory monitoring and reporting IAS is your complete solution if you need that level of service, or we can augment your core competencies as desired. IAS handles reinsurance accounting, 1099 process and a range of complimentary functions. Lastly, IAS delivers all services with technology and processes customized to your unique needs.

When you’re tied up with insurance accounting administration, you have less time to focus on what matters to your business: selling insurance, managing surplus and reserves, and expanding your company’s market share. IAS provides comprehensive accounting and reporting services covering the full spectrum of insurance products and complex reinsurance treaties, so you can devote internal resources to executing business strategy, not entering credits and debits. Learn more about our Accounting & Reporting Services.

We take the headache out of insurance compliance with all-inclusive administrative support services that ensure you stay current on all insurance regulatory requirements. By monitoring and communicating time-sensitive compliance issues, we have developed long-standing, trusted relationships with state insurance departments and other regulatory agencies. We also review updates from the Centers for Medicare & Medicaid Services (CMS) for any federal changes that affect the insurance business and our clients. Learn more about our Compliance & Regulatory Support Services.

Speed your time to market for new product offerings by letting IAS manage the filing process from start to finish. Through our depth of experience and extensive industry connections, we can artfully navigate regulatory issues and state insurance requirements to obtain approval quickly and grow your company’s portfolio. Avoid the headache and complexity of product filing by entrusting your business to the experts at IAS.

Our proprietary software solutions and best-of-breed commercial systems work together to create a highly scalable and easily adaptable environment for an insurance administrative solution customized to your needs. IAS’ standard inbound interfaces include eligibility files, payroll deposit files, Lockbox, and CC/EFT reject files, while our standard outbound interfaces cover all policy data, premium and commission calculations, actuarial and general ledger functions. Beyond the standards IAS routinely builds custom interfaces to allow the exchange and flow of information to and from your platforms as needed to support full conversions or new business. IAS’ IT professional services staff are seasoned insurance industry experts who leverage their experience and knowledge to keep development costs low while optimizing the technology behind our administrative solutions. Our fully redundant data centers keep your client information secure.

We manage portals for agents, policyholders and insurance providers, with each site offering an ever-expanding array of self-service capabilities. Our policyholder dashboard gives your clients easy access to the tools they need to apply for coverage and manage their account online. Our agent portal includes a robust compensation system and end-to-end commission management support, and our proprietary software can be customized to meet the needs of your business. Producers can easily manage their business and track their earnings with a few keystrokes, reducing paper waste, minimizing back-office workload and increasing agent loyalty. Learn more about our Agent Services & Portal.